How does crowdfunding impact the success and sustainability of startups in comparison to traditional funding methods?

Research Paper by Mythri Maddisetty

One of the biggest obstacles many startups encounter is a lack of funding. However, crowdfunding has emerged as a viable alternative financing method that offers unique advantages and challenges compared to more traditional funding sources such as venture capital, angel investors, or bank loans. Crowdfunding allows entrepreneurs to obtain additional financing through non-bank channels, with many people donating money online through various campaigns.

“Crowdfunding is a non-bank financing option in which startups accept small donations from many people to receive a much-needed cash boost to get their ventures off the ground. Entrepreneurs typically launch crowdfunding campaigns via Internet platforms; they set time frames for raising money and disclose specific monetary goals. Crowdfunding contributors can include friends, family members, investment groups, personal investors, and those who simply are interested in your venture. The goal is to attract as many potential investors as possible” (Johnson, 2024).

A visual display below explains the different methods

“The 2008 financial crisis led to the rise of crowdfunding. As banks enforced stricter lending policies post-recession, small businesses struggled to secure credit, prompting many to seek alternative funding methods. In 2023, the global crowdfunding market volume was estimated at $1.17 billion, showing a slight increase from previous years” (Smith, 2024).

According to Statista, the transaction value of the global crowdfunding sector is expected to grow by 1.48% annually from 2024 to 2028, reaching a market volume of $1.27 billion by 2028

- Donation-based crowdfunding: In this type, individuals donate small amounts of money to help the project reach a larger goal, and they do not expect any financial return. GoFundMe is a well-known platform for donation-based crowdfunding.

-Equity crowdfunding: This idea is similar to how a common stock is sold on a stock exchange or on a venture capital. Equity crowdfunding is where a certain amount of stake in the business is sold to a number of investors who would invest in the business which would result in the business gaining finance. SeedInvest and CircleUp are popular platforms for equity-based crowdfunding.

- P2P crowdfunding: With this method, entrepreneurs receive money from individuals who expect to be paid back with interest by a specific deadline. This is similar to borrowing from a bank, but the funds come from a larger pool of investors. This is also a form of peer to peer lending. LendingClub and Prosper are well-known platforms for debt-based crowdfunding.

-Debt securities crowdfunding: This is the type of crowdfunding where people invest in a debt security issued by a company which is also called a bond elsewhere.

- Reward-based crowdfunding: In this type, individuals donate money to companies or entrepreneurs with the expectation of receiving something in return, which may not necessarily be financial. Examples of reward-based crowdfunding platforms include Kickstarter and Indiegogo.

-Hybrid models: Like the name states this type of crowdfunding is the result of combining two or more types of crowdfunding and interchanging them. For example, Seedrs combines equity crowdfunding with rewards-based elements.

Advantages of Traditional Funding Methods

Larger Investments: Venture capital firms and angel investors typically provide larger sums of money, allowing startups to scale more rapidly and pursue ambitious goals.

Expertise and Networks: Traditional investors often bring industry expertise, strategic guidance, and valuable networks that can help startups navigate challenges and identify opportunities.

Longer-Term Focus: Traditional investors are more likely to focus on the long-term growth and sustainability of the company, providing support and resources beyond a single product or campaign.

Advantages of Crowdfunding

Accessibility: Crowdfunding platforms make it easier for startups to reach a large pool of potential investors, regardless of their location or network. This accessibility can benefit underrepresented founders or those outside major startup hubs. “It’s a private funding source that won’t be impacted by a poor credit score or minimal business experience. All you need is a well-thought-out business idea to attract supporters” (Johnson, 2024).

Validation: A successful crowdfunding campaign can serve as proof of concept and market validation, demonstrating demand for the startup’s product or service. This validation can attract further investment from traditional sources.

Community Building: Crowdfunding allows startups to engage with their target audience and build a community of supporters who are invested in their success. This community can provide valuable feedback, advocacy, and even become early adopters or loyal customers.

Retain Control: Unlike traditional funding methods, where investors often gain equity and a say in decision-making, crowdfunding allows founders to retain more control over their company’s direction and vision.

Marketing: Crowdfunding could also act as a way to reach your product and service to the customers as it acts as a way of marketing and this could be a way to reach individuals and create an effective customer base.

Risk: Crowdfunding also has a lower risk compared to other ways of investment as the investors do not need to worry about economic or stock market factors that would hinder or affect their investment.

Multiple Campaigns: Crowdfunding also helps investors to fund multiple or more than one campaign which would diversify their options and would also allow multiple start ups to gain funding.

Time Saving: Crowdfunding is more efficient compared to other traditional methods as it is less time consuming and with the right platform crowdfunding can help the individuals create a story.

Feedback: Crowdfunding helps the start ups to gain essential feedback to better their product or services as one of the greatest advantages of crowdfunding is how close they are to their customers and this could be one of the major factors that the customers could be the ones that could generate more ideas for the business.

“Additionally, crowdfunding can empower individuals to invest in projects in which they believe, potentially leading to more diverse funding sources and fairer access to capital. Crowdfunding can also support the development of innovative solutions to social and environmental challenges” (Nisar, 2024).

Challenges of Crowdfunding:

Limited Funds: Crowdfunding campaigns typically raise smaller amounts compared to traditional funding rounds. This can limit a startup’s ability to scale quickly or pursue capital-intensive projects.

Short-Term Focus: Crowdfunding often focuses on a specific product or initiative rather than the long-term growth of the company. This short-term focus can make it challenging for startups to plan for sustainable growth and future funding needs.

Public Scrutiny: Crowdfunding campaigns are public, which means that a startup’s failures or missteps are also visible to everyone. Negative publicity from a failed campaign can hurt a startup’s reputation and future prospects. “Campaign creators face the responsibility of fulfilling their promises and delivering the intended outcomes of their projects. However, logistical challenges, unforeseen delays, or difficulties in project execution can lead to dissatisfaction among contributors and harm the reputation of the crowdfunding platform” (Supekar, 2024).

Administrative Burden: Running a successful crowdfunding campaign requires significant time and resources for marketing, communication, and fulfillment. This can distract founders from other critical aspects of building their business.

Crowdfunding would require a good and effective marketing strategy which would include having a good story and conveying the right message as it should be according to the interest of potential investors and driving an interest in a product could be extremely challenging given that there could either be multiple competitors or it could be a new product the customers never heard of.

The crowdfunding story and campaigns you created should become popular and create excitement in the crowd and your vision and mission should be clearly shown in the campaigns. “Campaigners must create compelling and unique campaigns to stand out among the numerous crowdfunding initiatives vying for attention. It requires a well-thought-out marketing strategy, engaging content, and effective storytelling to capture the interest and support of potential donors in the highly competitive crowdfunding environment” (Supekar, 2024).

“Only about 4 out of 10 projects on Kickstarter will be successful. It means that the project doesn’t reach the goal that was set at the beginning. The good news is that the unsuccess rate of projects is decreasing each year as Kickstarter has built a lot of trust with customers as a brand and has a very good idea of how to run successful projects. In the future, they hope to bring the Kickstarter projects fail rate below 50%” (Woodward, 2024).

Impact of Crowdfunding on Startups

“The digital age has given rise to crowdfunding, a unique method for organizations and individuals to raise capital from a large group of people. For those seeking funds, it involves creating a compelling pitch and setting a target on a crowdfunding site like GoFundMe, IndieGoGo, or Kickstarter. While large donations are beneficial, it’s often the many smaller contributions that help capital seekers reach their goals” (Smith, 2024).

Challenges in Traditional Funding

An entrepreneur’s journey is seldom easy. Attracting funding is one of the most difficult components of building a startup, and typical funding sources, such as venture capital or small-business loans, are not always available. This is especially true for first-time founders and ideas that could be considered specialized. Raising finance is critical for any company’s growth. Larger, more established firms frequently find it easier to get investments or new debt from lenders. However, smaller businesses and startups frequently encounter substantial hurdles in this area. This is where crowdsourcing proves useful.

Crowdfunding as a Solution

Crowdfunding was created to fill this void, as well as to honor enthusiasts by allowing those who will use, watch, or read the finished product to contribute to its creation, by way of contributing to funding of the startup by providing their amount to crowdfunding. It is an altogether new way to fundraising than traditional approaches. In crowdfunding, an individual in need of financial assistance approaches a large pool of investors or donors and seeks small funds from each investor to collect the necessary amount, whereas in the traditional method, a business owner may approach an institution or moneylender to request funds. The traditional fundraising procedure has a limited number of investors.

Advantages of Crowdfunding over Traditional Methods

“The most obvious advantage of crowdfunding for a start-up company or individual is its ability to provide access to a larger and more diverse group of investors or supporters. With the ubiquity of social media, crowdfunding platforms are an incredible way for businesses and individuals to both grow their audience and receive the funding they need” (Smith, 2024). In addition to the advantages of crowdfunding as highlighted in the previous section of the paper, crowdfunding has some unique attributes that prove beneficial for startups. Crowdfunding platforms help empower entrepreneurs and individuals to broadcast a unique business idea across a broad spectrum of social media channels. Entrepreneurs have complete control over the campaign’s marketing efforts, from start to final feedback. By assessing the responses of target audiences, advertising efforts may be easily tweaked. One can also use several web marketing platforms to reach the appropriate audience at the right time.

Streamlined Fundraising

Crowdfunding Platforms helps streamline all fundraising activities, such as creating a fundraiser campaign, sharing an appeal, collecting or withdrawing funds, and sending out individual feedback letters, all under a single roof. “Crowdfunding works for all kinds of companies at all different stages, but the companies that have the most successful campaigns tend to have the largest and most engaged communities behind them — usually of customers or users or other supporters of their mission” (Nguyen, 2023).

Successful Crowdfunding Case Studies

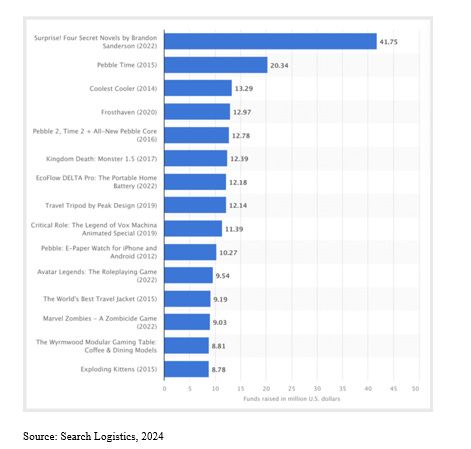

The case studies below highlight some of the most successful crowdfunding efforts in recent history. To achieve their objectives, each used a unique set of techniques and tools. The case studies demonstrate that there are numerous approaches to successfully crowdfund a new company. It is critical to establish a clear vision for the company and give investors a compelling reason to invest. Furthermore, it is critical to assemble a strong team of supporters who will help promote the initiative.

The Pebble Time and Oculus Rift were groundbreaking crowdfunding campaigns that achieved remarkable success on Kickstarter. The Pebble Time smartwatch raised over $20 million, making it one of the most successful campaigns on the platform. Notably, the Pebble Time watch was the first of its kind to be compatible with both iOS and Android devices, a unique feature that significantly contributed to its popularity and successful fundraising efforts. The company leveraged various promotional strategies, including the creation of informative videos outlining the features of the watch and offering early bird pricing to attract supporters.

Similarly, the Oculus Rift, one of the first virtual reality headsets on the market, raised over $2 million on Kickstarter. The success of the campaign can be attributed to its promise of a high-quality virtual reality experience and its ability to attract a diverse audience of tech enthusiasts and gamers. The campaign also demonstrated strong vision and leadership by effectively communicating its vision to backers and securing industry endorsements from notable figures in the tech and gaming industries, such as John Carmack of id Software. Promotion for the campaign included the creation of a compelling video showcasing the features of the headset and offering early bird pricing to incentivize supporters.

Both campaigns successfully tapped into the power of crowdfunding by engaging their target audiences, leveraging unique product features, and employing effective promotional strategies to secure substantial funding for their respective projects.The following graph shows ’15 Most Successful KickStarter Projects’ of all time.

Source: Search Logistics, 2024

This Kickstarter graph shows that it’s not all about price. Both high-ticket and low-ticket products can work on Crowdfunding Platforms. The key to success is creating great, innovative products that your audience will love.

Picking the right Crowdfunding Platform

We need to consider certain aspects of the business to determine which crowdfunding platform would most likely help the business. We need to understand the nature of the business or the project, we then need to understand the the amount of finance the business would require, we then validate the business in the market to know what the customer thinks and get valuable feedback on how to overcome the weaknesses of the product or service. The next step would be to understand what kind of ownership would one like their company to have, if one does not want the ownership to go to someone with no prior knowledge on investment then they most likely would not use an equity based crowdfunding platform. The business would also look at the legalities of each platform to understand which one would be less complex.

Factors Contributing to Startup Success

A strong business idea is crucial for a startup to succeed. Without a compelling product or service, the business will struggle to survive. The idea should align with potential customers’ needs and desires. The level of innovation and how well the idea meets customer needs significantly impact business growth.

An effective marketing strategy is essential. The success of a product depends on how actively it is promoted to the target audience. Launching the product to a specific target audience that corresponds to the relevant market segment is essential.

Timing is also a critical factor. The economic climate, including interest rates and recessions, can significantly impact a startup’s success.

Access to required capital is vital. Lack of finance is a common reason for startup failure. Different entrepreneurs have varying sources of finance. For instance, a sole trader may rely solely on personal funds, which may not be sufficient for capital expenditure.

The amount of finance available and how it is allocated to capital and revenue expenditures significantly influence a business’s financial performance.

Market growth is a key performance driver. The business’ effectiveness in the market directly impacts its success. The potential for sales revenue growth is a critical factor as it directly affects the business’s financial performance.

Conclusion

The future of crowdfunding is promising and full of potential. Online crowdfunding platforms have democratised and facilitated fundraising, empowering individuals, startups, and nonprofits to bring their ideas to life and positively impact society. With the increasing popularity of crowdfunding, the integration of social media, and favourable government regulations, the crowdfunding landscape is set to expand further.

“Crowdfunding platforms have also simplified the process for SMEs to access international markets. By selling goods and services online, SMEs can bypass physical borders and reach a wider audience without hefty transport costs” (NISAR, 2024).

It has helped foster innovation and entrepreneurship by providing an alternate source of finance, especially for businesses that struggle to meet stringent lending requirements. Crowdfunding effectively distributes the financial risk by mobilising a large pool of contributors who invest smaller amounts. This risk-sharing approach makes it more viable to pursue innovative projects that are too risky for individual investors or lenders. “The impact of crowdfunding extends beyond financial support, fostering community engagement, market validation, and a sense of shared ownership among backers, making it a dynamic force in the entrepreneurial landscape” (Polatos et al, 2023).

Way Forward

As analysed, crowdfunding has various advantages over traditional funding but it also faces multiple challenges which need to be mitigated to reap the benefits of crowdfunding. “The lack of robust regulations can expose investors to fraud, misinformation, and project failure. Investors, especially unsophisticated ones, may need additional protection from misleading information and unfair practices. Likewise, if large-scale crowdfunding platforms fail, it could have negative consequences for the financial system. Overly generous support for crowdfunding may also discourage businesses from seeking traditional financing, potentially leading to inefficiencies” (Nisar, 2024).

From a lack of awareness and trust to complicated regulations and limited investor protection, these hurdles require attention and proactive measures to ensure the country’s sustainable development of online crowdfunding. As a result, policy-makers need to implement regulations that protect investors without stifling business innovation. They can also educate potential investors about the risks and rewards of crowdfunding and the rules and safeguards available.

“As crowdfunding continues to grow, there will be an increased emphasis on transparency and accountability. Platforms will implement robust verification processes to ensure the authenticity of campaigns, and donors will have access to detailed updates on utilising funds. This heightened transparency and accountability will build trust among contributors and foster a culture of integrity within the crowdfunding ecosystem” (Supekar, 2024).

Estimated Market Size of Crowdfunding Industry

The Crowdfunding Market size is estimated at USD 1.5 billion in 2024, and is expected to reach USD 3.11 billion by 2029, growing at a CAGR of 15.70% during the forecast period (2024–2029).

Therefore, crowdfunding has gained immense popularity and has provided opportunities for individuals and organisations. It has its challenges and understanding these hurdles can help both campaigners and contributors navigate the crowdfunding landscape effectively. Understanding the intricacies of crowdfunding, mitigating the challenges associated and making the most of its benefits can foster a thriving crowdfunding ecosystem that empowers individuals and organisations and drives positive change.

Bibliography

Johnson, Simone. “What Is Crowdfunding?” Business News Daily, businessnewsdaily.com, 14 Feb. 2019, www.businessnewsdaily.com/4134-what-is-crowdfunding.html.

Center, Becky. “Council Post: With vc Money Slowing, Crowdfunding Is Increasing — Here’s How to Have a Successful Campaign.” Forbes, www.forbes.com/sites/forbesbusinesscouncil/2023/09/08/with-vc-money-slowing-crowdfunding-is-increasing-heres-how-to-have-a-successful-campaign/.

Supekar, Darshan. “Simplifying the Future of Crowdfunding in India | Ketto.” Www.ketto.org, 24 Sept. 2023, www.ketto.org/blog/future-of-crowdfunding-in-india#:~:text=Predictions%20for%20the%20Future%20of.

European Commission. “Crowdfunding Explained.” Single-Market-Economy.ec.europa.eu, 2023, single-market-economy.ec.europa.eu/access-finance/guide-crowdfunding/what-crowdfunding/crowdfunding-explained_en.

“Types of Crowdfunding for Startups: Four Types to Know | Stripe.” Stripe.com, stripe.com/in/resources/more/four-types-of-crowdfunding-for-startups-and-how-to-choose-one.

“Case Studies of Successful Crowdfunding.” FasterCapital, fastercapital.com/startup-topic/Case-studies-of-successful-crowdfunding.html#:~:text=Some%20examples%20of%20successful%20crowdfunding%20campaigns%20include%3A.

“Crowdfunding Market Size.” Www.mordorintelligence.com, www.mordorintelligence.com/industry-reports/crowdfunding-market/market-size.

https://www.facebook.com/mattwoodwarduk. “Kickstarter Stats & Facts 2023: Everything You Need to Know.” Www.searchlogistics.com, 18 July 2022, www.searchlogistics.com/learn/statistics/kickstarter-stats-facts/.